halbergman

Intro

GrowGeneration ( NASDAQ: GRWG) shares have actually dropped 18% YTD. In spite of the reality that the shares of the business are reasonably affordable, I think that it is still not the very best time to go long due to, in my individual viewpoint, the unpredictability of future patterns.

Financial investment thesis

In my individual viewpoint, regardless of the business’s technique to enhance running margins, we might still see pressure in the coming quarters, as the majority of business is still in the retail section, where very same shop sales are low and set business expenses are high up on salaries and lease can result in a deleverage impact. In addition, the work to substantially lower running expenses has actually currently been carried out in 2022, so I do not see the capacity for additional expense optimization in the following quarters.

Business summary

GrowGeneration is taken part in the production and sale of hydroponics. The primary earnings section is the retail section, nevertheless, the business likewise offers in the e-commerce and wholesale sections. According to the outcomes of the first quarter of 2023, the business has 55 retailers, the business runs in the United States market in 17 states.

1Q 2023 Profits evaluation

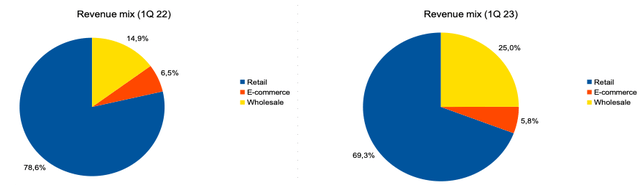

The business reported bet ter than financiers anticipated. Profits reduced by 30.5% YoY to $56.8 million due to a 36.6% decline in very same shop sales: YoY. The retail and e-commerce sections made the biggest contribution to the decrease in earnings, where earnings reduced by 39% YoY and 38% YoY, respectively, while in the wholesale section, earnings increased by 16.4%. Therefore, the share of earnings from the wholesale section increased from 15% in Q1 2022 to 25% in Q1 2023. You can see the information in the chart below.

Profits by section (Business’s info)

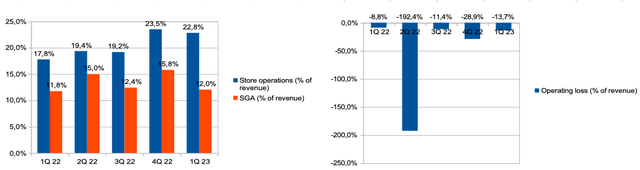

Gross earnings margin increased from 27.1% in Q1 2022 to 28.7% in Q1 2023. SGA costs (% of earnings) increased a little from 11.8% in Q1 2022 to 12% in Q1 2023, while shop operations (% of earnings) increased a little from 17.8% in Q1 2022 to 22.8% in 1Q 2023 due to lowered organization scale and deleverage impact, as part of business expenses associated with shops is repaired. Therefore, running loss (% of earnings) increased from 8.8% in Q1 2022 to 13.7% in Q1 2023.

Margin patterns (Business’s info)

According to the outcomes of the first quarter of 2023, the quantity of money on the business’s balance sheet is $72 million, there is no financial obligation.

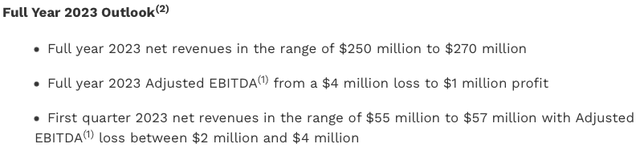

Management declared the assistance it offered earlier based upon 2022 outcomes. Management anticipates constant enhancement in earnings and margin characteristics throughout 2023.

Assistance 2023 (Business’s info)

My expectations

On the one hand, I like the business’s technique, which concentrates on earnings development and enhancing organization success. Therefore, the management prepares to continue increasing the share of personal label brand names, which must support the gross margin level in the retail section in the next quarters. In addition, I think that possibly we can see brand-new M&A deals at an appealing cost.

On the other hand, I want to explain the following realities. Initially, regardless of enhancements in the gross margin, we still see pressure on running margins. According to the outcomes of the first quarter of 2023, the share of the retail section has to do with 70% of the business’s overall earnings, because the majority of the business expenses related to servicing the chain’s shops are repaired (lease, income). Therefore, lowered economies of scale due to weak need in the market might continue to put pressure on the combined success of business.

Second Of All, regardless of the business’s concentrate on minimizing expenses and increasing success, I do not believe we will see a substantial decrease in running expenses throughout 2023, as the business has actually currently made substantial optimizations in 2022. This is verified by the words of the business’s management throughout the Profits Call following the outcomes for the first quarter of 2023.

As the business lowered its cost base by over $20 million in 2022, we are not anticipating additional substantial decreases in 2023.

Therefore, I confess that we will see some enhancement in success patterns throughout 2023, nevertheless, in my individual viewpoint, this will not suffice to make a financial investment choice to purchase shares.

Threats

Margin: a downturn in the intro of brand-new personal label brand names might put pressure on the gross margin. In addition, tax boosts in the market might have an unfavorable effect on the net earnings of business and lower the interest of prospective financiers in the business’s shares.

Macro (basic): high inflation and a decrease in genuine non reusable earnings might add to a decline in need for the business’s items, which might have an unfavorable effect on both organization development and success due to lowered economies of scale.

Motorists

Margin: increasing the share of personal label brand names might increase running margins, as management states the gross margin is greater in the personal label brand names classification. Therefore, the share of personal label brand names in the business increased from 10.8% in Q1 2022 to 16.1% in Q1 2023.

M&A: high money on the business’s balance sheet and absence of financial obligation, paired with basic pressure in the market, can offer the business with appealing M&A chances at an appealing cost, which can have a favorable effect on both organization volume and market share, along with combined success.

Volume: federal legalization of the business’s items can offer substantial assistance to both sales volumes and support the typical market price of items, nevertheless, this chauffeur is, in my individual viewpoint, low-probability, and its application might take a long time.

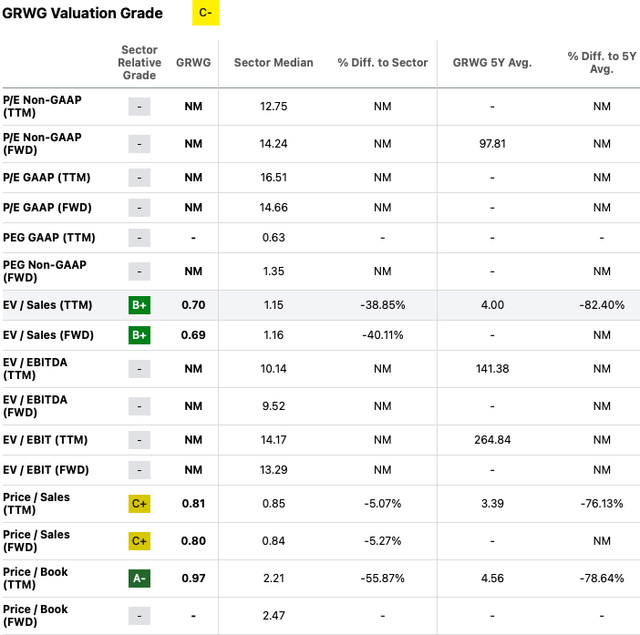

Evaluation

In spite of the reality that the business’s shares are not costly relative to historic worths, in my individual viewpoint, it is unworthy making a financial investment choice to purchase based just on an appealing evaluation in accordance with multiples. We are presently not able to compute significant multiples such as P/E & & EV/EBITDA as Earnings & & EBITDA are unfavorable. According to the P/S numerous, the business trades near to the market average.

Conclusion

Therefore, in my individual viewpoint, now is not the very best time to go into long positions based exclusively on the business’s low evaluation relative to historic worths. I think that financiers require to wait on the outcomes over the next couple of quarters to see if the marketplace has actually truly supported at existing levels and if the business has the ability to show an enhancement in running margins offered the modification in organization volume. In addition, I want to hear more information and efforts from management on how the business can continue to enhance margins in addition to development in personal label brand names, as high repaired shop expenses might continue to put pressure on us if we do not see healing in the market and the development of the business’s organization volumes.