William_Potter

Financial Investment Thesis

A dividend earnings oriented financial investment portfolio brings you the advantages of making an additional earnings by means of dividend payments without the requirement to offer positions from your financial investment portfolio to get capital gains.

The goal of this short article is to reveal you how to construct such a portfolio utilizing my leading 30 stocks of the month of June. The portfolio is comprised of high dividend yield business, dividend development business and development business.

I have actually built this portfolio in such a way so that it offers you with an appealing Weighted Average Dividend Yield [TTM] of 3.58%, which suggests that it can assist you make a considerable quantity of additional earnings by means of dividend payments.

In addition to that, it can be highlighted that the picked choices have actually revealed a Weighted Average Dividend Development Rate [CAGR] of 11.05% over the previous 5 years, showing that the portfolio ought to likewise supply you with considerable Dividend Development in the years ahead.

The following are my leading 10 high dividend yield business for June 2023:

- Allianz ( OTCPK: ALIZF, OTCPK: ALIZY)

- Altria (NYSE: MO)

- AT&T (NYSE: T)

- BB Seguridade Participações ( OTCPK: BBSEY)

- Johnson & & Johnson ( JNJ)

- Kinder Morgan ( KMI)

- The Bank of Nova Scotia ( BNS)

- United Parcel Service ( UPS)

- U.S. Bancorp ( USB)

- Verizon Communications Inc. ( VZ)

Here are my leading 10 dividend development business for June 2023:

- Apple (NASDAQ: AAPL)

- BlackRock (NYSE: BLK)

- Canadian Natural Resources Limited (NYSE: CNQ)

- Goldman Sachs (NYSE: GS)

- JPMorgan (NYSE: JPM)

- Mastercard (NYSE: MA)

- Microsoft (NASDAQ: MSFT)

- Nasdaq (NASDAQ: NDAQ)

- The Charles Schwab Corporation (NYSE: SCHW)

- Union Pacific Corporation (NYSE: UNP)

And these are my leading 10 development business for June 2023:

- Adobe ( ADBE)

- Alphabet ( GOOG, GOOGL)

- Amazon ( AMZN)

- Palo Alto Networks ( PANW)

- PayPal ( NASDAQ: PYPL)

- Salesforce ( CRM)

- T-Mobile ( TMUS)

- Tesla ( TSLA)

- The Trade Desk ( TTD)

- XP ( XP)

Summary of the 30 picked Picks for June 2023, the picked ETF, and the Portfolio Allotment

|

Business Call |

Sector |

Market |

Nation |

Dividend Yield [TTM] |

Div Development 5Y |

Allotment |

Quantity in $ |

|

Adobe |

Infotech |

Software |

United States |

0% |

0.00% |

1.5% |

375.00 |

|

Allianz |

Financials |

Multi-line Insurance Coverage |

Germany |

5.45% |

5.72% |

3.0% |

750.00 |

|

Alphabet |

Interaction Provider |

Multimedia and Provider |

United States |

0% |

0.00% |

2.0% |

500.00 |

|

Altria |

Customer Staples |

Tobacco |

United States |

8.21% |

7.18% |

3.5% |

875.00 |

|

Amazon |

Customer Discretionary |

Broadline Retail |

United States |

0% |

0.00% |

2.0% |

500.00 |

|

Apple |

Infotech |

Innovation Hardware, Storage and Peripherals |

United States |

0.54% |

7.26% |

2% |

500.00 |

|

AT&T |

Interaction Provider |

Integrated Telecommunication Provider |

United States |

6.81% |

-5.78% |

3.0% |

750.00 |

|

BB Seguridade Participações S.A. |

Financials |

Multi-line Insurance Coverage |

Brazil |

9.19% |

13.89% |

2.0% |

500.00 |

|

BlackRock |

Financials |

Property Management and Custody Banks |

United States |

2.97% |

13.60% |

3% |

750.00 |

|

Canadian Natural Resources Limited |

Energy |

Oil and Gas Expedition and Production |

Canada |

4.12% |

21.83% |

2% |

500.00 |

|

Johnson & & Johnson |

Healthcare |

Pharmaceuticals |

United States |

2.84% |

6.11% |

3.0% |

750.00 |

|

JPMorgan Chase & Co. |

Financials |

Diversified Banks |

United States |

2.93% |

12.91%(* )3% |

750.00 |

Kinder Morgan |

|

Energy |

Oil and Gas Storage and Transport |

United States |

6.75% |

14.16% |

2.0 & % |

500.00 |

Mastercard |

|

Financials |

Deal & Payment Processing Provider |

United States |

0.57% |

17.66% |

2% |

500.00 |

Microsoft |

|

Infotech |

Systems Software Application |

United States |

0.84% |

10.02 % |

2% |

500.00 |

Nasdaq |

|

Financials |

Monetary Exchanges and Information |

United States |

1.47% |

9.57% |

1% |

250.00(* )Palo Alto Networks |

Infotech |

|

Systems Software Application |

United States |

0% |

0.00 % |

1.0% |

250.00 |

PayPal |

Financials |

|

Deal & Payment Processing Provider |

United States |

0% |

0.00% |

1.5% |

375.00 |

Salesforce |

Infotech |

|

Software |

United States |

0% |

0.00% |

1.00% |

250.00 |

Schwab U.S. Dividend Equity ETF |

ETFs |

|

ETFs |

United States |

3.75% |

15.56% |

40.0% |

10,000.00 |

T-Mobile |

Interaction Provider |

|

Wireless Telecommunication Provider |

United States |

0%(* )0.00% |

1.0% |

250.00 |

Tesla |

Customer Discretionary |

Vehicle Producers |

|

United States |

0% |

0.00% |

1.5% |

375.00 |

The Bank of Nova Scotia |

Financials |

Diversified Banks |

|

Canada |

6.24% |

4.38% |

2.0% |

500.00 |

The Charles Schwab Corporation |

Financials |

Financial Investment Banking and Brokerage |

|

United States |

1.78% |

21.16% |

1% |

250.00 |

The Goldman Sachs Group |

Financials |

Financial Investment Banking and Brokerage |

|

United States |

2.94% |

25.93% |

3% |

750.00 |

The Trade Desk |

Interaction Provider |

Marketing |

|

United States |

0% |

0.00% |

1.0%(* )250.00 |

U.S. Bancorp |

Financials |

Diversified Banks |

United States |

|

6.31% |

10.00% |

2.0% |

500.00 |

Union Pacific Corporation |

Industrials |

Rail Transport |

United States |

|

2.65% |

14.83% |

1% |

250.00 |

United Parcel Service |

Industrials |

Air Cargo and Logistics |

United States(* )3.67% |

|

12.53%(* )3.0% |

750.00(* )Verizon Communications |

Interaction Provider |

Integrated Telecommunication Provider |

United States (* )7.21% |

2.04%(* )3.0% |

750.00 |

XP |

|

Financials |

Financial Investment Banking and Brokerage |

Brazil(* )0% |

0.00% |

1.0% |

250.00(* )3.58%(* )11.05 %(* )100% |

25000 |

Click to expand |

|

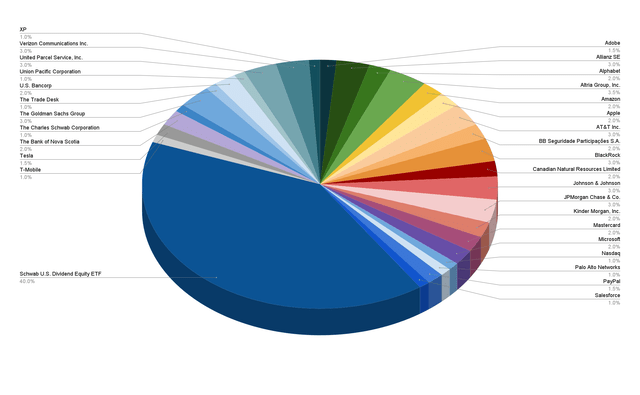

Source: The Author(* )Portfolio Allotment per Company/ETF |

The Schwab U.S. Dividend Equity ETF( NYSEARCA: |

SCHD |

) has the greatest portion of the total financial investment portfolio (40%). This assists us to reach a broad diversity over sectors and markets along with to increase the Weighted Average Dividend Yield and Weighted Average Dividend Development Rate of this portfolio. |

The following business represent the biggest specific positions of the financial investment portfolio: |

Altria (3.5%) (* )Allianz (3% ) |

AT&T (3%) |

BlackRock( 3%) |

|

Johnson & Johnson( 3 %) |

JPMorgan( 3%) |

The Goldman Sachs Group( 3% ) |

United Parcel Service( 3%) |

I have actually picked these business to have the greatest portion as I think that each of them is an appealing choice in regards to threat and benefit( I think about the threat level to be fairly low while thinking about the anticipated substance yearly rate of go back to be fairly high ).

In addition to that, each of these choices offers financiers with an appealing Dividend Yield and they can for that reason assist your portfolio to improve its Weighted Average Dividend Yield. Furthermore, I think that each of them can add to offering your portfolio with Dividend Development, therefore assisting you increase your yearly earnings in the type of dividends from year to year.

The following business are underweighted, representing less than 2% of the total financial investment portfolio: Adobe( 1.5%) PayPal (1.5%)

Tesla (1.5%)

- Nasdaq( 1%)

- Palo Alto Networks( 1%)(* )Salesforce( 1%)

- T-Mobile (1%)

- The Charles Schwab Corporation( 1%)

- The Trade Desk( 1%)

- Union Pacific Corporation (1%)(* )XP( 1% )(* )I have actually chosen to provide a lower portion since I think about the threat level for these choices to be greater( for instance since of their greater Assessment )and/or they do not pay a dividend.

- Because the goal of this financial investment portfolio is to supply you with an appealing Dividend Yield, I normally supply business that do not pay a Dividend with a lower percentage of the total portfolio in order to increase its Weighted Average Dividend Yield.

- Illustration of the Portfolio Allotment per Company/ETF

- Source: The Author

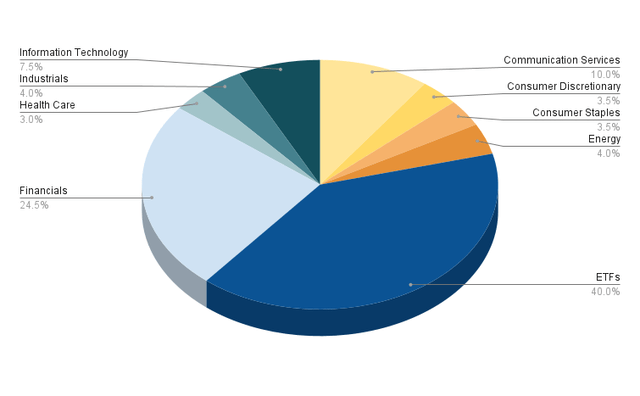

Portfolio Allotment per Sector

It can be highlighted that, leaving out the ETF Sector( which is represented by the Schwab U.S. Dividend Equity ETF ), the Financials Sector represents the greatest portion of the total financial investment portfolio( with 24.5%).(* )The business from the Financials Sector that have the greatest percentage of the total portfolio are Allianz (3%), BlackRock( 3%), JPMorgan (3%), and The Goldman Sachs Group( 3%). BB Seguridade Participações S.A., Mastercard, The Bank of Nova Scotia, and U.S. Bancorp have a portion of 2% each. PayPal represents 1.5 %of the total portfolio, and Nasdaq, The Charles Schwab Corporation and XP represent 1%.

The Interaction Solutions Sector comprises 10% of the total financial investment portfolio with AT&T and Verizon representing 3% each, Alphabet comprises 2%, while T-Mobile and The Trade Desk represent 1% each.

- Within the total financial investment portfolio, the Infotech Sector represents 7.5%. Apple and Microsoft represent 2% each, Adobe 1.5% and Palo Alto Networks and Salesforce 1% each.

- The Energy Sector, which represents 4% of the total portfolio, is comprised by Canadian Natural Resources Limited (2%) and Kinder Morgan (2%).

- The Industrials Sector, which represents 4% of the portfolio, is represented by United Parcel Service (3%) and Union Pacific Corporation (1%).

- The Customer Discretionary Sector (with Amazon comprising 2% and Tesla 1.5%) and the Customer Staples Sector (with Altria representing 3.5%) comprise 3.5% each.

- The Healthcare Sector is represented by Johnson & & Johnson and comprises 3% of the overall portfolio.

- Illustration of the Portfolio Allotment per Sector when designating SCHD to the ETF Sector

- Listed below you can discover an introduction of the portfolio allowance when designating the Schwab U.S. Dividend Equity ETF to the ETF Sector.

- Source: The Author

- Below is a list of the sectors and their matching companies/ETF:

- ETFs (40%)

- Schwab U.S. Dividend Equity ETF (40%)

Financials (24.5%)

Allianz (3.0%)

BB Seguridade Participações S.A. (2.0%)

BlackRock (3.0%)

JPMorgan Chase & & Co. (3.0%)

Mastercard (2.0%)

Nasdaq (1.0%)

PayPal (1.5%)

The Bank of Nova Scotia (2.0%)

The Charles Schwab Corporation (1.0%)

The Goldman Sachs Group (3.0%)

U.S. Bancorp (2.0%)

XP (1.0%)

Interaction Provider (10%)

Alphabet (2.0%)

AT&T (3.0%)

T-Mobile (1.0%)

The Trade Desk (1.0%)

- Verizon Communications (3.0%)

Infotech (7.5%)

- Adobe (1.5%)

- Apple (2.0%)

- Microsoft (2.0%)

- Palo Alto Networks (1.0%)

- Salesforce (1.0%)

- Energy (4%)

- Canadian Natural Resources Limited (2.0%)

- Kinder Morgan (2.0%)

- Industrials

- (4%)

- Union Pacific Corporation (1.0%)

- United Parcel Service (3.0%)

Customer Discretionary (3.5%)

- Amazon (2.0%)

- Tesla (1.5%)

- Customer Staples (3.5%)

- Healthcare (3%)

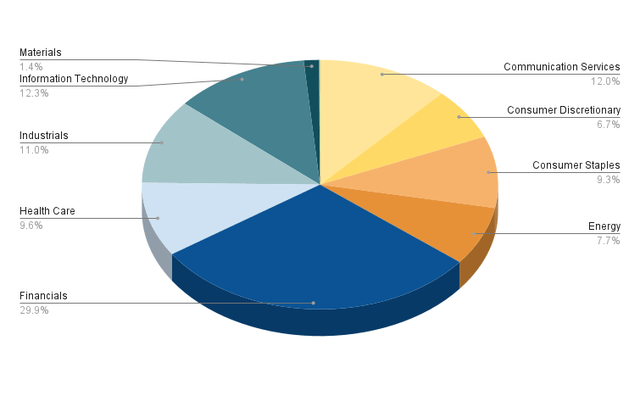

- Illustration of the Portfolio Allotment per Sector when designating the ETF amongst the business and Sectors it is bought

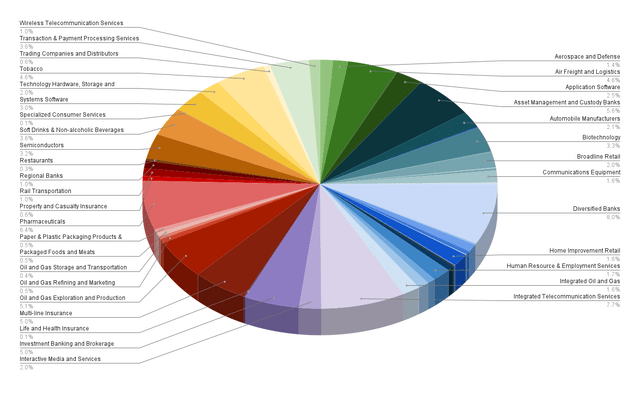

In the graphic listed below you can see the portfolio allowance per sector when designating the Schwab U.S. Dividend Equity ETF amongst the business and sectors in which the ETF is in fact bought (rather of designating the Schwab U.S. Dividend Equity ETF amongst the ETF sector as highlighted by the previous graphic).

- Source: The Author

- When designating the Schwab U.S. Dividend Equity ETF amongst the business and sectors it is in fact bought, it can be highlighted that the Financials Sector represents 29.9% of the total portfolio, therefore being the sector with the greatest percentage.

- The 2nd biggest is the Infotech Sector with 12.3%, followed by the Interaction Solutions Sector with 12%, the Industrials Sector with 11%, the Healthcare Sector with 9.6%, and the Customer Staples Sector with 9.3%.

- The Energy Sector comprises 7.7% of the total portfolio and the Customer Discretionary Sector 6.7%. A smaller sized portion comes from the Products Sector (with 1.4%).

- Due to the reality that no sector represents more than 30% of the total portfolio and the majority of the sectors comprise less than 15%, I think that this portfolio reaches a broad diversity over sectors, therefore adding to minimizing its threat level.

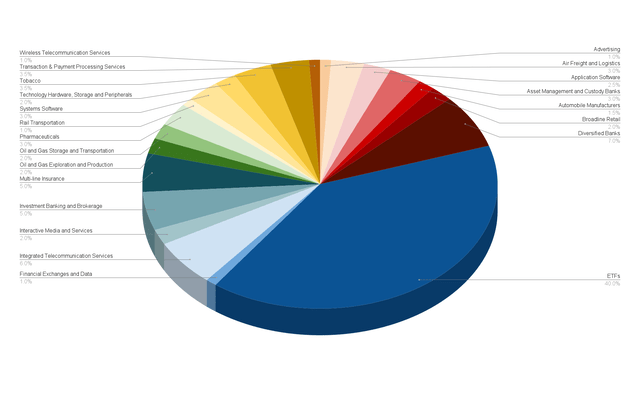

Portfolio Allotment per Market

- The graphic listed below programs the portfolio allowance per Market when designating the Schwab U.S. Dividend Equity ETF to the ETF Market.

- Leaving Out the ETF, the Diversified Banks Market (7% of the total portfolio) comprises the biggest portion of the total portfolio, followed by the Integrated Telecommunication Solutions Market (6%), the Multi-line Insurance Coverage Market (5%), the Financial Investment Banking and Brokerage Market (5%), the Deal & & Payment Processing Provider Market (3.5%), and the Tobacco Market (3.5%).

All other markets represent less than 3.5%, showing that this financial investment portfolio has not just reached a broad diversity over sectors, however likewise over markets. Illustration of the Portfolio Allotment per Market when designating SCHD to the ETF Market

- Source: The Author

- Illustration of the Portfolio Allotment per Market when designating the ETF amongst the business and Industries it is bought

The graphic listed below highlights the portfolio allowance per market when designating the Schwab U.S. Dividend Equity ETF amongst the business and markets in which it is in fact bought.

- Source: The Author

- It can be highlighted that the Diversified Banks Market represents the greatest portion of the total portfolio (8%), followed by the Integrated Telecommunication Solutions Market (7.7%), the Pharmaceuticals Market (6.4%), the Property Management and Custody Banks Market (5.6%), the Oil and Gas Expedition and Production Market (5.1%), the Financial Investment Banking and Brokerage Market (5%), and the Multi-line Insurance Coverage Market (5%). All other markets represent less than 5% of the total portfolio.

These numbers, when again, show that this financial investment portfolio reaches a broad diversity over markets, even when designating the Schwab U.S. Dividend Equity ETF amongst the business and markets it is in fact bought.

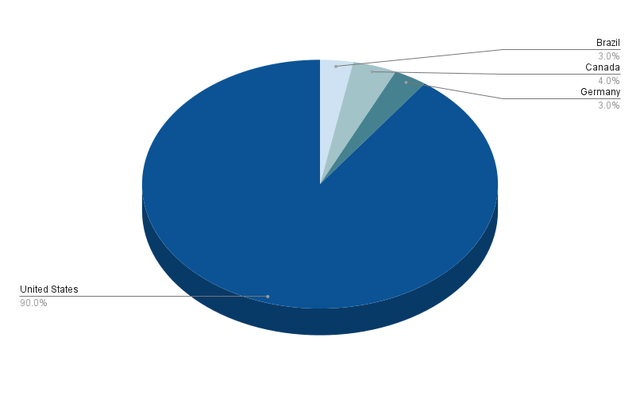

Portfolio Allotment per Nation

90% of this financial investment portfolio is represented by business from the United States, while 10% are from outside the U.S.

When taking a look at the business from outside the nation, it can be highlighted that 4% are from Canada (Canadian Natural Resources Limited and The Bank of Nova Scotia representing 2% each), 3% are from Brazil (BB Seguridade Participações S.A. representing 2% and XP accounting for 1%), and 3% are from Germany (represented by Allianz).

These numbers reveal that my geographical diversity requirements are satisfied. This holds true due to the reality that most of the picked business originate from the U.S. while a smaller sized portion (10%) is represented by business beyond the nation.

Illustration of the Portfolio Allotment per Nation

Source: The Author

How to accomplish an even More comprehensive Diversity

If you wish to accomplish an even

more comprehensive diversity

than this financial investment portfolio uses, you may think about purchasing an extra ETF: you might take a more detailed take a look at the iShares Core Dividend Development ETF (NYSEARCA:

DGRO

), because it offers you with a reasonably appealing Dividend Yield

of 3.37% and a Dividend Development Rate

of 10.32% over the previous 5 years.

In case you ask yourself if it makes good sense to just buy SCHD, I wish to

highlight some benefits

of selecting stocks separately over just purchasing ETFs:

It offers your portfolio with more uniqueness and versatility

You can safeguard your financial investment portfolio versus the next stock exchange crash by including

business with a low Beta Element (an example of a business with a low Beta Element would be Johnson & & Johnson, which becomes part of this portfolio)

You can obese markets with which you are more familiar and you can prevent others you do(* )n’t desire

to buy

You can pick stocks which you

believe are

able to beat the marketplace or you can pick

ones

to raise the Weighted Average Dividend Yield or Weighted Dividend Development Rate of your financial investment portfolio You can likewise accomplish an even more comprehensive geographical diversity of your portfolio In my short article 10 Dividend Stocks To Program The Advantages Of Purchasing Specific Stocks Over ETFs I go over the benefits of the choice of stocks over ETFs in higher information.[TTM] Conclusion[CAGR] Utilizing a dividend earnings oriented financial investment technique brings you numerous advantages. You can end up being more independent from the strong cost changes of the stock exchange while at the exact same time, you do not have the need to offer a few of your stocks in order to get capital gains.

It permits you to utilize a buy-and-hold technique with prompt adjustments of your financial investment portfolio. In addition to that, you can increase the dividend payments you get from year to year when picking business which can supply your portfolio with dividend development in addition to dividend earnings. The objective these days’s short article was to construct a dividend earnings financial investment portfolio that can assist you reach this target. The Weighted Average Dividend Yield

- of this portfolio is 3.58%, showing that you can make a considerable quantity of additional earnings by means of dividend payments. Additionally, it can be highlighted that the picked choices of this portfolio have actually revealed a Weighted Average Dividend Development Rate

- of 11.05%, which recommends that you must have the ability to more raise the dividend payments you get every year. By doing this you have the ability to make an appealing quantity of additional earnings from today, while increasing this quantity on a yearly basis.

- Additionally, it can be highlighted that this portfolio has actually reached a broad diversity over sectors (no sector represents more than 30% of the total portfolio even when designating the Schwab U.S. Dividend Equity ETF amongst the business and sectors it is in fact bought) and markets (no market represents more than 8% of the total portfolio) in addition to a geographical diversity (90% of the business originate from the United States and 10% from beyond the nation), assisting you to minimize the threat level of your portfolio. Author’s Note: Thank you quite for reading and I would value hearing your viewpoint on this financial investment portfolio and its allowance! Do you own or prepare to get among the picked choices? If you wish to get a notice when I release my next analysis, you can click the ‘Follow’ button. Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.

-