Juan Jose Napuri

It’s been a combined start to the year for the rare-earth elements sector, with margins down on balance in Q1 2023 vs. Q1 2022 and somewhat greater capex year-over-year, impacting complimentary capital generation for the majority of manufacturers. Regrettably, the outcomes have actually been even less excellent from a reserve replacement perspective, with the majority of mines needing to ratchet up cut-off grades since of the effect from inflationary pressures. The outcome is that less than 30% of bigger gold manufacturers effectively changed reserves in 2022 and we saw comparable battles in the silver area.

Nevertheless, Hecla ( NYSE: HL) was one name to buck this pattern, ending the year with record silver reserves and silver-equivalent ounce [SEO] reserves assisted by its acquisition of Alexco at an appealing rate. Let’s go into the business’s FY2022 Reserve/Resource report a little closer listed below:

Keno Hill Silver District (Business Discussion)

2022 Reserves

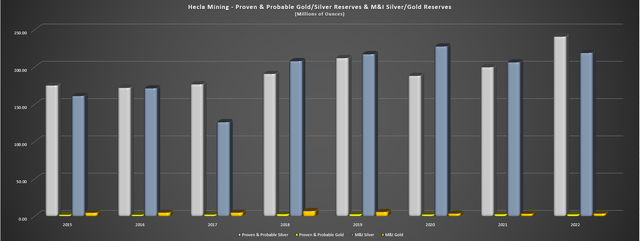

Hecla Mining launched its FY2022 Reserve & & Resource declaration previously this year, reporting a 21% boost in silver reserves to|240.9 million ounces, partly balanced out by a 6% decrease in gold reserves to|2.56 million ounces. Significantly, Hecla attained this development in silver reserves without pulling its silver rate presumption utilized to determine reserves greater, like we saw from a number of other manufacturers. Simply as notably, this development in silver reserves included an enhancement in grades, with the business including the ultra-high grade Keno Hill Mine in the Yukon to its reserve stock, with a typical silver grade of|770 grams per heap, overshadowing its previous typical grade of|420 grams per lots of silver with its ounces at Greens Creek (Alaska) and Lucky Friday (Idaho). Likewise worth keeping in mind and, as the chart listed below programs, Hecla’s determined & & suggested [M&I] silver resources likewise increased materially, with Hecla ending the year with|219.1 M&I silver ounces to support its big silver reserve base.

Hecla Mining – Proven & & Probable Gold/Silver Reserves & & M&I Silver/Gold Reserves (Business Filings, Author’s Chart)

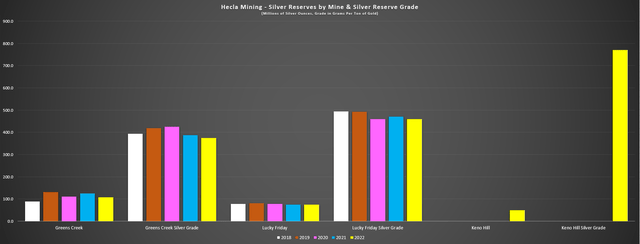

Going into the report a little closer, Hecla would not have actually effectively changed reserves without the advantage of an included|49.5 million ounces of silver from Keno Hill, with its reserves at Greens Creek decreasing to|108 million ounces at a somewhat lower typical grade of 374 grams per heap silver (FY2021:|387 grams per heap silver). Hecla kept in mind that the decrease in reserves at Greens Creek (7%, 1%, 4%, and 6% decreases in silver, gold, zinc, and lead reserves, respectively) was since of lower margin product and product near historic mined locations with unidentified backfill conditions being gotten rid of. The silver lining is that a research study is taking a look at whether these ounces can eventually be returned into reserves. On a favorable note, the business continues to strike motivating intercepts in the Upper Plate Zone, with mineralization broadened to the west with an emphasize obstruct of 3.8 meters of|305 grams per heap silver,|4.8 grams per lots of gold, and|16.9% lead/zinc or|1,150 grams per heap silver-equivalent.

Hecla Mining – Silver Reserves by Mine & & Silver Reserve Grade (Business Filings, Author’s Chart)

Taking a look at the business’s high-cost Casa Berardi Cash cow in Quebec, this property might not change reserves in 2022 either, with a 10% decrease in gold reserves to|1.6 million ounces (5.83 gram per heap gold underground grade, 2.74 gram per heap gold open-pit grade) associated to greater expenses that caused increased cut-off grades. The business called out greater steel, fuel, and specifically labor expenses from an inflationary perspective, which caused a boost in the cut-off grade for underground and open-pit product to 4.11 grams per lots of gold and 1.37 grams per lots of gold, respectively vs. 3.46 grams per lots of gold and 1.27 grams per lots of gold formerly. So, while Casa Berardi’s grades increased year-over-year, tonnage fell materially to|19.0 million loads (FY2021:|20.8 million loads), and with this product boost in cut-off grades it might be more challenging to change all mined exhaustion in the future.

Fortunate Friday Operations (Business Site)

On a favorable note, Lucky Friday changed mining exhaustion effectively, ending the year with|74.6 million ounces of silver reserves at a typical grade of|466 grams per heap silver and|12.0% lead/zinc. Presuming a typical throughput rate of|400,000 heap per year, the|6.0 million heap reserve base supports a 13+ year mine life, making this one of the longer life and greater grade possessions in the silver area sector-wide. And while M&I resources decreased, this was mostly to M&I ounces moving into the reserve classification, with some effect from increased cut-off grades. As highlighted in the report, NSR cut-off worths have actually increased from|$216.19/ heap at the 30 Vein to|$241.34/ heap, while NSR cut-off worths for the Intermediate Veins increased over 11% to|$268.67/ heap vs.|$241.34/ heap formerly.

That stated, and unlike other manufacturers, Hecla continues to utilize a fairly conservative silver rate presumption of $17.00/ oz, so it appears to have some space to flex reserves at Greens Creek and Lucky Friday if it were to increase its silver rate presumption closer to the market average near $19.00/ oz. And while reserve development based upon M&A isn’t the most preferable kind of reserve development, which is what Hecla attained in FY2022 (we would have seen|4% decrease in reserves if not for the acquisition of Keno Hill), the business paid the ideal rate for Keno Hill by purchasing the business after its share rate had actually gone through a violent correction, and it didn’t compromise on grades, jurisdiction or property quality like First Majestic ( AG) did, that made a leap of faith that didn’t settle as anticipated with its acquisition of Jerritt Canyon.

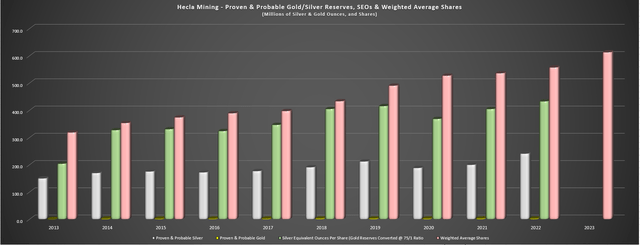

Reserves Per Share

While reserve development is necessary for any miner to offer exposure into future production and capital, the more crucial metric to see is reserve development per share. This is since the objective when purchasing miners is to get increased utilize to rare-earth elements, and if a business is seeing constant decreases in production, capital, and reserves per share, one is in fact getting unfavorable utilize and is most likely much better off simply owning the metal itself. Luckily, while there are numerous business with abysmal performance history of production and reserve development per share in the silver manufacturer area, Hecla is an exception. In reality, as the chart listed below highlights, the business has actually continued to increase its silver and silver-equivalent ounce reserves per show only modest development in its share count. And as highlighted formerly, this is regardless of utilizing a silver rate presumption to determine reserves that is listed below the market average ($ 17.00/ oz), with SEO reserves increasing from|204 million to|433 million from 2013 to 2022.

For contrast, First Majestic is utilizing a silver rate of $21.50/ oz in their 2022 year-end Reserve/Resource declaration.

Hecla Mining – Proven & & Probable Gold/Silver Reserves, Silver-Equivalent Ounces & & Weighted Average Shares (Business Filings, Author’s Chart & & FY2023 Price Quotes)

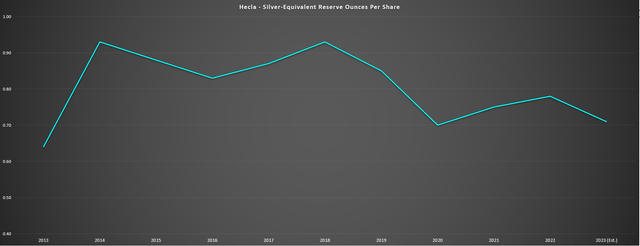

Taking a look at the chart listed below which tracks SEO reserves per share compared to its weighted typical yearly shares impressive, we can see that Hecla’s reserves per share are up vs. 2013 levels regardless of a hard years for the rate of silver and regardless of utilizing a lower silver rate presumption than at the start of the duration ($ 17.00/ oz vs. $20.00/ oz). That stated, the pattern has actually been down following the 2018 peak, so it’s not as excellent as other miners like Agnico Eagle ( AEM) that have actually continually increased reserves per share, with reserves per share most likely to strike a brand-new multi-decade high at year-end 2025 if not for any significant divestments. Still, Agnico Eagle is the gold requirement in the sector and among the business with the very best performance history from a reserve development per share perspective, and when compared to what’s readily available in the silver area like Coeur Mining ( CDE) with its reserve per share pattern revealed listed below, Hecla is head and shoulders above its peers and is among the top-3 names for keeping one’s utilize to metals vs. needing more shares to get the very same production/reserves like the majority of other silver names.

Hecla – Silver-Equivalent Ounces Per Share (Business Filings, Author’s Chart & & FY2023 Price Quotes) Coeur Mining – Gold Equivalent Ounces Per Share Held (Business Filings, Author’s Chart)

Current Advancements

Lastly, if we take a look at current advancements, Hecla might not include extra reserves based upon its suggested acquisition of ATAC Resources, however it will include significant resources in fairly close distance to its Keno Hill Task in Yukon Area. For those unknown, Atac Resources holds a huge land plan throughout its Rackla Gold Residential or commercial property, comprised of the Rau Task and Nadaleen Task with 1,700 square-kilometers of tenements and a huge prospective gold/polymetallic belt. After just a few years of drilling, ATAC defined a resource base of|2.24 million ounces of gold in between 2 deposits (Tiger at Rau and Osiris at Nadaleen), with well above typical grades of 3.19 grams per tonne of gold at Tiger [M&I grade] and 4.12 grams per tonne of gold at Rau [M&I grade). However, these are just two targets among several on the land package, with impressive results from several other polymetallic and gold targets such as Ocelot, Anubis, and Orion.

ATAC Resources – Rau & Nadaleen Projects, Yukon (Company Filings, Author’s Chart)

For now, Hecla has its hands full with increasing throughput at Lucky Friday and working to ramp up Keno Hill to full production, so I would expect this project to sit on the shelf for the time being. And while there’s normally not much value in adding a project that might not head into production for a decade or longer into a pipeline, the price paid here and the fact that Hecla is now operating in the Yukon with its Alexco acquisition made this a pass that was hard to pass up. In fact, the company paid just ~$24 million or less than $11.00/oz on measured, indicated, and inferred resources, resulting in less than 1% dilution for a ~33% increase in M&I gold ounces (~3.67 million ounces —> ~4.87 million ounces). Hence, I think this was a smart move, especially, especially given the district-scale land package with this being a low-risk (minimal share dilution), but very high reward bet on this asset.

Summary

While several silver producers have continued to see steady declines in reserves per share, Hecla is one of the few producers that’s seen growth in silver-equivalent reserves over the past ten years, even if the trend has been slightly negative since the 2018 peak. Notably, this outperformance from a reserve growth per share basis complements its production growth per share, and the company hasn’t leaned on higher silver prices to ensure successful reserve replacement, with its silver price assumption of $17.00/oz well below the industry average. That said, and as highlighted in my most recent update, I still don’t see enough margin of safety in Hecla’s stock here, with the stock trading at ~32x FY2024 EV/FCF estimates (~$105 million) and ~1.50x P/NAV when there are some precious metals names trading at less than 10x FY2024 free cash flow estimates and well below 1.0x P/NAV.

Free cash flow is defined as operating cash flow minus growth and sustaining capital.

Hecla – Historical Cash Flow Multiple (FASTGraphs.com)

Some investors might argue that Hecla deserves a significant premium for its Tier-1 jurisdiction profile 50% plus all-in sustaining cost margins, a rarity in the silver space with most producers operating out of Tier-2 jurisdiction. And while I agree with this assessment, I continue to see the current valuation as a little rich, and I prefer to buy miners only when they’re hated and on sale, neither of which is the case with Hecla currently. Hence, I continue to see better opportunities elsewhere in the sector. That said, if Hecla were to decline below US$4.15 per share where it would at closer to ~1.25x P/NAV and closer to ~12.0x EV/FY2024 operating cash flow estimates, I would view this as a buying opportunity.

.