Farewell pandemic refi cash-outs. Hi HELOCs?

Home-equity credit lines (HELOCs) and second-lien home loans have actually been staging a noteworthy return as U.S. house owners try to find liquidity and methods to generate income from the pandemic rise in house costs, according to BofA Global.

It utilized to be that debtors resting on an approximated $33 trillion stack of equity developed in their houses might merely re-finance and take out money, up until the Federal Reserve’s quick rate walkings started squelching the choice.

Now, with home mortgage rates above 6%, and the Fed penciling in 2 more rate walkings in 2023, cash-strapped house owners have actually been looking for options to draw out money from their residential or commercial properties.

While cash-out refinances toppled 83% in the 4th quarter of 2022 from a year prior to, HELOCs increased 7% and home-equity loans grew 31%, according to the current TransUnion information.

” Debtor need stays high, especially offered family budget plans have actually been pushed by increasing food and energy expenses,” a BofA Worldwide credit technique group led by Pratik Gupta’s, composed in a weekly customer note.

Risky loans to subprime debtors and house equity items assisted speed up the 2007-2008 international monetary crisis and the age’s wave of ravaging house foreclosures.

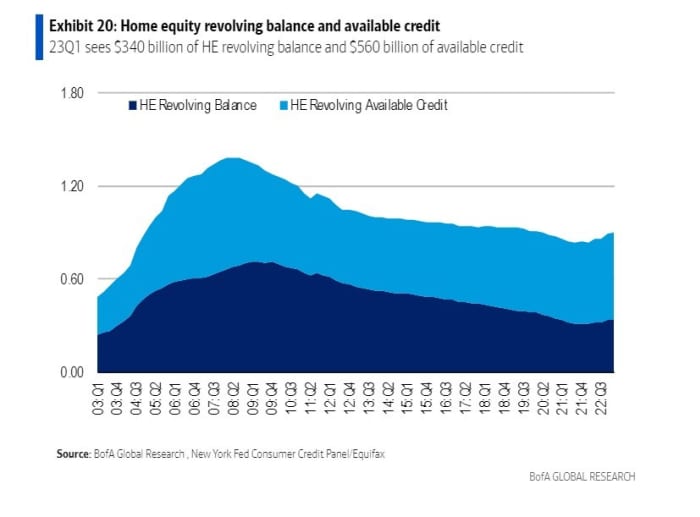

At the time, homes had more than $1.2 trillion of house equity revolving and offered credit (see chart), whereas the figure was closer to $900 billion in the very first quarter of this year.

House equity items are making a huge return as homes look for liquidity

BofA Worldwide, New York City Fed Customer Credit Panel/Equifax.

The pandemic rise in house costs saw costs almost double in some locations, offering a huge increase to house equity levels. The Urban Institute pegged house equity in the U.S. at $33 trillion since Might, up from a post-2008 peak of about $15 trillion.

BofA experts argued this time house equity items look various, with approximately $17 trillion of tappable equity throughout 117 million U.S. house owners, and many debtors having high credit report and low rates.

” The large bulk of that– $14 trillion– is from the accomplice of house owners who own their houses totally free & & clear,” Gupta’s group composed.

Another $1.6 trillion of equity might be offered from Freddie Mac and Fannie Mae debtors, according to his group, which pegged an approximated 94% of all impressive U.S. first-lien house mortgages now listed below 4% rates.

Significant banks own the bulk of house equity balances (see chart), led by Bank of America Corp.

BAC,.

PNC Bank.

PNC,.

Wells Fargo,.

WFC,.

JPMorgan Chase.

JPM,.

and People.

CFG,.

according to the group, which keeps in mind a number of other significant banks appear to have actually struck time out on their programs.

A smaller sized part of HELOCs and second-lien home loans have actually been securitized, or packaged up and offered as bond offers, while nonbank lending institutions have actually been using the items too.

Stocks were combined Monday, taking a time out from a current rally, as financiers kept track of weekend tumult in Russia. The Dow Jones Industrial Average.

DJIA,.

was up about 0.1%, while the S&P 500 index.

SPX,.

was 0.2% lower and the Nasdaq Composite.

COMPENSATION,.

was down 0.7%, according to FactSet.

Associated: The economy was expected to collapse by now. It hasn’t– and GDP is set to increase once again.