In these times, double down– on your abilities, on your understanding, on you. Join us Aug. 8-10 at Inman Link Las Vegas to lean into the shift and gain from the very best. Get your ticket now for the very best rate

In spite of unexpected strength in work and real estate need, the U.S. economy continues to decrease and Federal Reserve tightening up is most likely to result in a “ modest economic downturn” in the last 3 months of 2023, economic experts at Fannie Mae forecast.

In a projection launched Monday, economic experts with Fannie Mae’s Economic and Strategic Research Study (ESR) Group stated that it’s difficult to state exactly when an economic crisis will strike. However forecasters at the home loan giant state by the time Fed policymakers see information revealing inflation has actually cooled enough to bring rates pull back, an economic crisis will most likely be inevitable.

” Our standard expectation is that the Fed will keep financial policy tighter till core inflation is plainly suppressed, which is not most likely to take place till there is clear proof of labor market softening,” Fannie Mae forecasters stated “By the time that takes place an economic crisis will have likely been set in movement. We for that reason see the Fed’s choice concerning how high and long to keep rates as a significant danger over the next year, with the concern of a slump more a matter of ‘when’ than ‘if.'”

Given That March 2022, the Fed has actually authorized 10 rate boosts, bringing the short-term federal funds rate to a target of in between 5 percent and 5.25 percent. At their June 14 conference, Fed policymakers held back on another rate walking however left the door available to future tightening up.

Fed policymakers predicted that the benchmark federal funds rate will require to come up by another half a portion point prior to inflation is beat, and futures markets presently put the chances of a 25-basis point boost in July at 77 percent.

However the concern is not just how high the Fed will raise rates, however the length of time it will keep them raised. Fannie Mae forecasters state they think the Fed’s assistance that more rate walkings might be in shop was likewise planned as a caution that policymakers will remain in no rush to cut rates.

” Among the historic lessons of the 1970-80s inflationary age was that inflation can quickly come roaring back if financial policy reducing starts too soon,” Fannie Mae economic experts stated, keeping in mind that a rebound in oil costs or house costs might reignite inflation. “Up until there is strong proof of core inflation being included, the concern of reaccelerating inflation through too-early policy reducing will stay present.”

However if the economy does continue to slow, the Fed is anticipated to reverse course on rates this year or next– especially if the U.S. goes into an economic crisis. The so-called “ dot plot” from the Fed’s June 14 conference reveals most Fed policymakers do not anticipate to cut rates this year, however they do see the federal funds rate boiling down next year.

The CME FedWatch Tool, which tracks bets put on futures markets, anticipates a 66 percent opportunity that the Fed will have decreased rates by a minimum of half a portion point by this time next year.

Home loan rates anticipated to alleviate

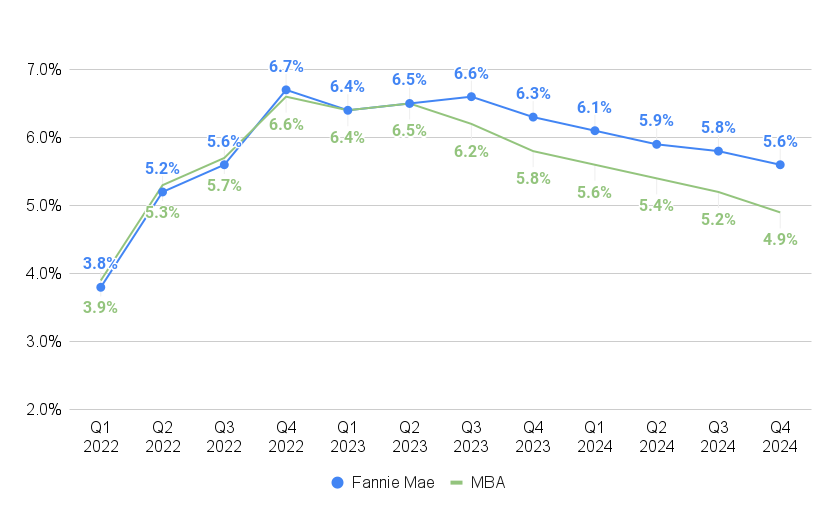

Source: Fannie Mae and the Home Loan Bankers Association projections

That describes why economic experts at Fannie Mae and the Home Loan Bankers Association (MBA) anticipate home loan rates will alleviate this year and next. In a June 20 projection, MBA economic experts anticipated rates on 30-year fixed-rate home mortgages will drop to approximately 5.8 percent throughout the last 3 months of this year. In their most current projection, Fannie Mae economic experts do not see that taking place till the 3rd quarter of 2024.

Doug Duncan

Core inflation stays sticky, “making it most likely in our view that it preserves a limiting posture for longer than the majority of market individuals at first expected,” stated Fannie Mae Chief Financial Expert Doug Duncan in a declaration

” On the other hand, real estate costs continue to reveal more powerful development than what was formerly anticipated offered the suddenness and substantial magnitude of home loan rate boosts,” Duncan stated. “Real estate’s efficiency is a statement to the strength of demographic-related need in the face of Infant Boomers aging in location and Gen-Xers securing traditionally low rates, both of which have actually assisted keep real estate supply at traditionally low levels.”

New-home sales revealing strength

Source: Fannie Mae June 2023 real estate projection

While homebuilders continue to contribute to that supply, “years of weak homebuilding over the previous company cycle implies the imbalance will likely continue for a long time,” Duncan stated. “We do anticipate real estate will be encouraging of the general economy as it exits the modest economic downturn.”

The absence of stock and in 2015’s rise in home loan rates developed cost problems that are now anticipated will drive a 14.3 percent drop in 2023 house sales to 4.86 million.

” The real estate market continues to have an incredibly minimal supply of houses for sale, in part due to the fact that of the continuous lock-in result, in which existing owners are disincentivized to note their houses due to not wishing to quit a home loan rate much lower than present market rates,” Fannie Mae forecasters stated. “Tight stocks are triggering a sluggish speed of existing house sales, while likewise reanimating home rate development and need for brand-new houses.”

While Fannie Mae anticipates sales of existing houses will fall by 16.2 percent this year to 4.213 million, new-home sales are predicted to grow by 1 percent, to 647,000.

New-home sales might complete the year even more powerful, offered what Fannie Mae economic experts defined as a “ blowout real estate begins report” launched after their projection was finished. That report reveals real estate starts in May published their greatest boost in 7 years.

” Our company believe that a few of this dive is most likely analytical sound in an infamously unpredictable series and will likely draw back or be modified moving forward,” Fannie Mae economic experts stated. “Single-family real estate licenses, which tend to be more a sign of the hidden pattern, likewise increased, however by a smaller sized 4.8 percent.”

However, “the licenses information indicate a clear upward pattern in current months, and this accompanies enhancement in homebuilder belief,” and contractors have the capability to increase building and construction to a yearly speed of 1 million houses in the months ahead.

Next year, Fannie Mae forecasters see sales of existing houses getting by 3.2 percent to 4.348 million, as home loan rates pull back.

Falling rates anticipated to restore home loan refinancing

Fannie Mae’s most current projection is for home loan originations to grow by 19.7 percent next year to $1.901 trillion, driven by an 83 percent increase in refinancing volume to $493 billion as home loan rates alleviate.

Purchase loan originations are likewise anticipated to grow by 7 percent in 2024 to $1.408 trillion. That’s $60 billion less than projection in April, thanks mostly to current information that reveals more property buyers are paying money rather of securing home mortgages.

” In a high-rate environment, it makes financial sense for some potential property buyers to prevent securing a home loan completely,” Fannie Mae forecasters kept in mind.

Get Inman’s Home Loan Quick Newsletter provided right to your inbox. A weekly roundup of all the greatest news worldwide of home mortgages and closings provided every Wednesday. Click on this link to subscribe.