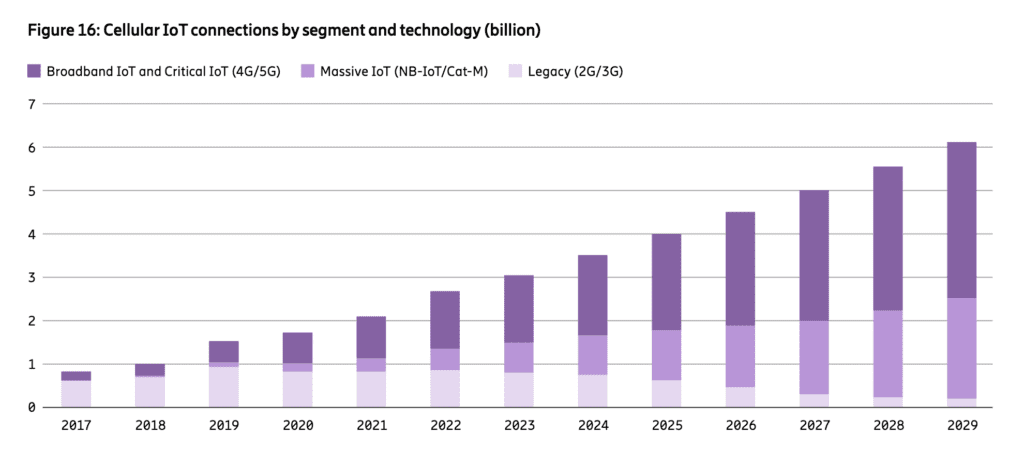

The overall variety of cellular IoT connections will reach around 3 billion at the end of 2023, reckons Ericsson, with a lot of, and the increasing bulk, linked on so-called ‘broadband’ cellular IoT innovations LTE (4G) and 5G. The arrival of reduced-capability (RedCap) 5G through 2024/5 will even more enhance this ‘broadband’ sector, stated the Swedish supplier.

The twin narrow( er)- band IoT innovations NB-IoT and LTE-M (Cat-M) will continue to take share from tradition 2G and 3G, however will stay off the rate set by LTE and 5G– the essentials likewise of the mobile market’s personal networking push. The most recent instalment of Ericsson’s bi-annual Movement Report, offered here, states 1.6 billion (53 percent) of the overall cellular-IoT projection will be on LTE and 5G by the end of the year.

By contrast, a brief view of a bar chart (see listed below) supplied with the report recommends cellular IoT will represent closer to 600 million by the end of 2023. Ericsson priced estimate GSMA statistics that 128 mobile operators have actually now released or commercially released NB-IoT networks and 60 have actually released LTE-M (Cat-M), while 45 are running both innovations in tandem.

On The Other Hand, the very same chart states around 800 million IoT gadgets will still be linked on either 2G or 3G by year-end, however Ericsson stated the switch-off rate for these networks will see an unfavorable yearly development rate of around 20 percent approximately 2029. By 2029, virtually absolutely nothing will be linked on 2G and 3G, while broadband IoT and ‘huge’ (narrowband) IoT will represent about 3.65 billion and 2.2 billion connections, respectively (once again, composed without the accurate figures to hand).

Particularly, Ericsson specified: “By the end of 2029, nearly 60 percent of cellular IoT connections are anticipated to be broadband IoT, with 4G linking the bulk.” It stated the lion’s share of cellular IoT activity remains in the North East Asia area– that includes China, significantly, and is anticipated to pass 2 billion (out of 3 billion; 66 percent of) cellular IoT connections in 2023.

Of interest, too, the report states broadband IoT usage cases are mainly served by 4G LTE gadget classifications 1 and 4 (feline 1 and feline 4), however the usage case possibilities are broadening with the intro of RedCap-based 5G New Radio (NR) gadgets. Cellular IoT will grow at a compound yearly rate (CAGR) of 12 percent through to 2029; the variety of broadband IoT (feline 1 and feline 4) and vital IoT (full-fat 4G-LTE and 5G) will double in three-to-four years, stated Ericsson.

Remarkably, the report does not yet integrate a projection for RedCap connections– which Ericsson compares to cat-4 efficiency with “enhanced latency, plus gadget energy and spectrum performances”. As recommendation, it places RedCap as a 5G-native option to mid-range classification 1-through-4 LTE gadgets, using peak downlink/uplink information rates from 50/35 Mbps to 240/175 Mbps in the most basic gadgets, and from 130/45 Mbps to 645/235 Mbps in advanced gadgets.

RedCap modules and gadgets, likewise supporting 5G NR functions such as boosted positioning and network slicing, will be commercially offered throughout 2024, it stated. These will allow easier and smaller sized 5G modules, which need to open-up a lot of brand-new usage cases, stated Ericsson. It noted customer wearables, IoT gadgets, and AR glasses, plus “inexpensive routers, video cameras, high-end meters, and fixed-wireless gain access to (FWA) gadgets”.

In time, RedCap will likewise become a commercial IoT innovation, it stated. The United States, China, Australia, and some Asian markets will be “frontrunner markets” for RedCap, it stated.

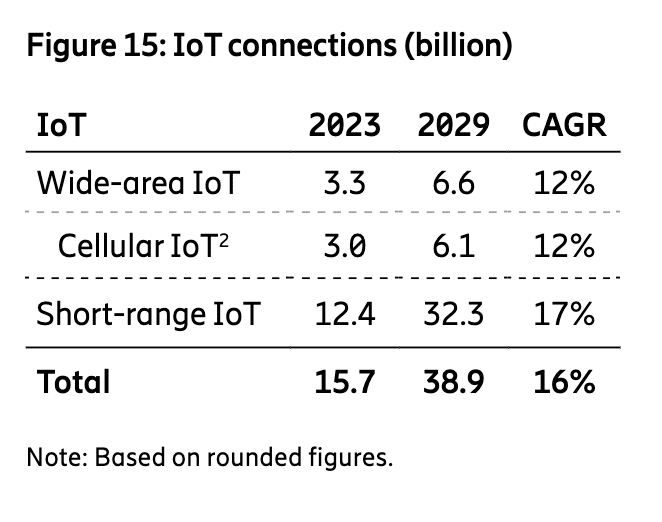

However the IoT findings explain something else, too: that cellular IoT represents, and will continue to represent, a piece of the broader IoT market. The overall variety of wide-area IoT connections, which counts non-cellular IoT connections on innovations like LoRaWAN and Sigfox, will reach 3.3 billion by the end of 2023 and 6.6 billion by 2029, growing at a substance rate (CAGR) of 12 percent– which is the very same in the duration when it comes to the cellular IoT sub-segment.

The non-cellular share of wide-area IoT will go from around 9 percent (300 million connections) in 2023 to around 7.5 percent (500 million) in 2029. These other camps will disagree with the figures, plainly. However a lot of substantially, the overall IoT market deserves 15.7 billion connections currently (2023-end), indicating cellular IoT is just accountable for a portion of it (about 19 percent).

And the rest of the marketplace– controlled by brief- and mid-range innovations like Bluetooth, RFID, and Wi-Fi, significantly, plus a variety of exclusive 805.14 mesh innovations– will grow at 17 percent in the duration to 2029, by contrast, upping its cumulative share from 79 percent in 2023 to 83 percent in 2029. Possibly Ericsson’s next Movement Report will consist of a RedCap projection, to see if that makes a distinction to the specific niche tale of huge IoT.